Your Difference between refinance and home images are ready in this website. Difference between refinance and home are a topic that is being searched for and liked by netizens today. You can Get the Difference between refinance and home files here. Get all royalty-free vectors.

If you’re looking for difference between refinance and home images information related to the difference between refinance and home topic, you have come to the ideal blog. Our site frequently provides you with hints for seeing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

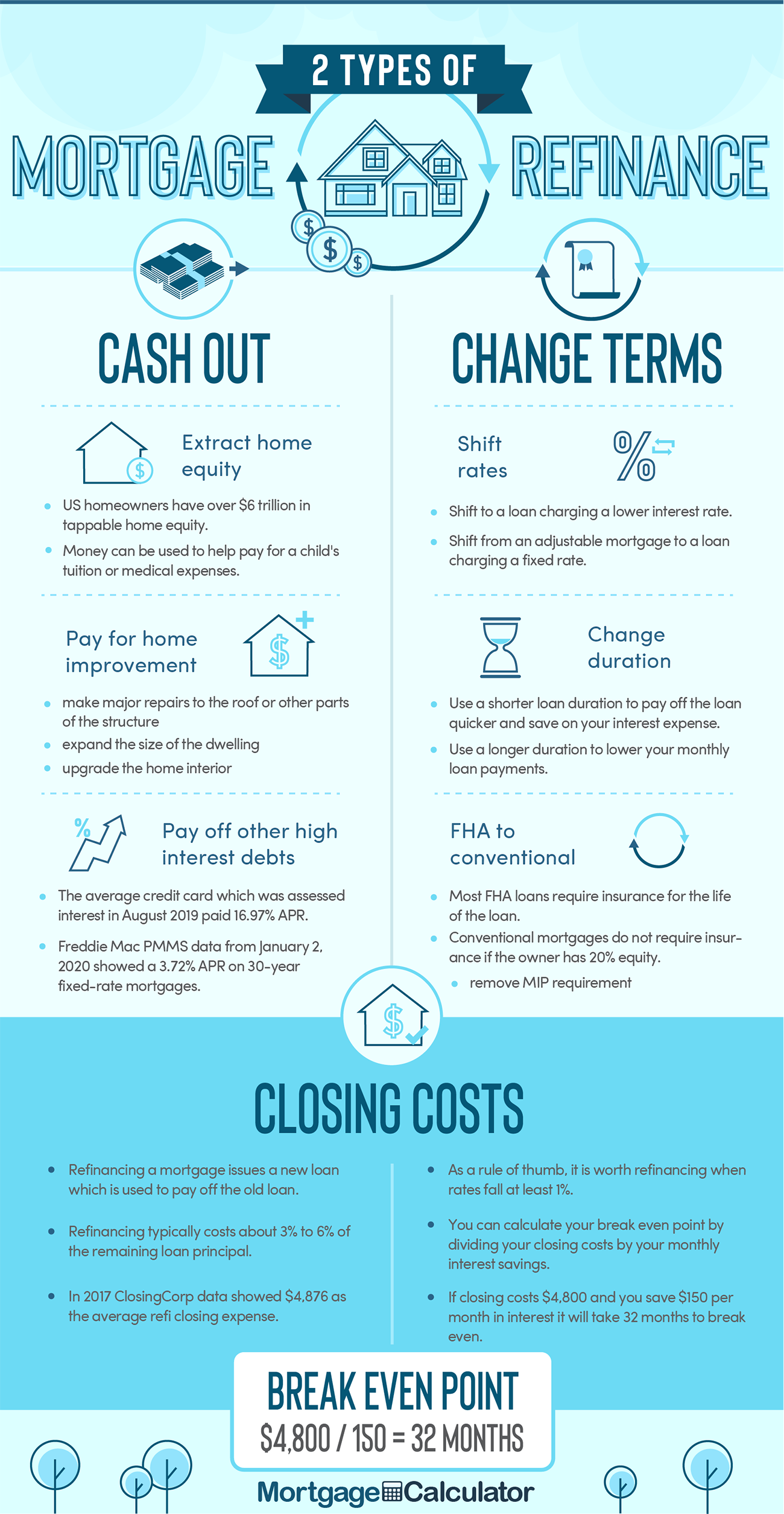

Difference Between Refinance And Home. Whats the Difference Between Refinancing My Home and Getting a Second Mortgage. Essentially its a line of credit being extended by your lender and thus you will pay interest on it. Get personalized rates. Understanding The Difference Between Mortgage Refinance Home Equity Loan.

Equity In Your House Can Be Used To Fund Large Purchases Like Home Improvements There Are Two Basic Equity Loans You Can Home Equity Line Home Equity Equity From pinterest.com

Equity In Your House Can Be Used To Fund Large Purchases Like Home Improvements There Are Two Basic Equity Loans You Can Home Equity Line Home Equity Equity From pinterest.com

The purchase mortgage is what allows someone to become a homeowner without having enough cash on hand. A refinance loan is the loan you obtain when you already own a home with a mortgage and would like to refinance that existing loan into another loan. Shorter loans may have higher monthly payments associated with them. If youre having trouble paying a mortgage one option is to refinance. Most home equity loans are for 10 to 15 years. Understanding The Difference Between Mortgage Refinance Home Equity Loan.

For some there is confusion between a mortgage refinance loan and a home-equity loan.

This means taking out a new loan with a lower interest rate which should lower the monthly payment. You would like to borrow money to reorganize your finances or possibly make some improvements to the home. Difference Between Home Equity And Refinance - If you are looking for a way to reduce your expenses then our service can help you find a solution. The main difference is that a cash-out refinance will lead to paying off and closing your original mortgage while a home equity loan only will be an additional loan. If you refinance your home for its current value you could access the equity accumulated in your property. Refinances on the other hand allow homeowners to make changes to their existing mortgage rates.

Source: in.pinterest.com

Source: in.pinterest.com

Both home equity loans and. You can also refinance to a lower interest rate if market rates are lower now than when you got your loan. You cannot refinance without first having a mortgage. The differences between a home equity loan and a refinance could entail higher interest rates higher costs or a loan that doesnt fit your needs. This means taking out a new loan with a lower interest rate which should lower the monthly payment.

Source: pinterest.com

Source: pinterest.com

Comparing your home equity options infographic The chart below summarises the differences between your three options to accessing your home equity. This means taking out a new loan with a lower interest rate which should lower the monthly payment. Purchase mortgages may have. Others urge you to leave that first. A home-loan refinance may lower your equity in the property.

Source: pinterest.com

Source: pinterest.com

Cash-out refinance pays off your existing first mortgage. It will result in a new payment amortization schedule which shows the monthly payments you need to make in order. Others urge you to leave that first. Essentially its a line of credit being extended by your lender and thus you will pay interest on it. This means taking out a new loan with a lower interest rate which should lower the monthly payment.

Source: pinterest.com

Source: pinterest.com

Get personalized rates. Quite a few homeowners use the terms interchangeably and often think they are the same. The main difference is that a cash-out refinance will lead to paying off and closing your original mortgage while a home equity loan only will be an additional loan. If youre having trouble paying a mortgage one option is to refinance. Basically equity is the difference in value between what you owe on an asset and the value of that asset.

Source: pinterest.com

Source: pinterest.com

Comparing your home equity options infographic The chart below summarises the differences between your three options to accessing your home equity. Through home refinancing you can apply to access this equity. This means taking out a new loan with a lower interest rate which should lower the monthly payment. It will result in a new payment amortization schedule which shows the monthly payments you need to make in order. The purchase mortgage is what allows someone to become a homeowner without having enough cash on hand.

Source: pinterest.com

Source: pinterest.com

The main difference is that a cash-out refinance will lead to paying off and closing your original mortgage while a home equity loan only will be an additional loan. Shorter loans may have higher monthly payments associated with them. You would like to borrow money to reorganize your finances or possibly make some improvements to the home. However the paid-off loan can stay on your credit report for up to 10 years and continue to impact your scores during that time. It will result in a new payment amortization schedule which shows the monthly payments you need to make in order.

Source: pinterest.com

Source: pinterest.com

Purchase mortgages may have. If youre having trouble paying a mortgage one option is to refinance. To find out lets take a closer look at each. A purchase loan is a loan that you obtain when borrowing money from a mortgage lender to purchase a home. This results in a new mortgage loan which may have different terms than your original loan meaning you may have a different type of loan andor a different interest rate as well as a longer or shorter time period for paying off your loan.

Source: pinterest.com

Source: pinterest.com

A refinance loan is the loan you obtain when you already own a home with a mortgage and would like to refinance that existing loan into another loan. Comparing your home equity options infographic The chart below summarises the differences between your three options to accessing your home equity. There are some people who have different definitions of what is a refinance and a remortgage. Get personalized rates. Most home equity loans are for 10 to 15 years.

Source: pinterest.com

Source: pinterest.com

You would like to borrow money to reorganize your finances or possibly make some improvements to the home. Cash-out refinance pays off your existing first mortgage. Understanding The Difference Between Mortgage Refinance Home Equity Loan. You can have a purchase mortgage without a refinance loan. There are some people who have different definitions of what is a refinance and a remortgage.

Source: pinterest.com

Source: pinterest.com

The argument is that the former concerns moving a loan to a new lender while the latter refers to sticking to the same existing lender for your home loan with a restructured loan. You can lower your monthly payment by taking a longer term or you can own your home faster and save on interest by shortening it. Cash-out refinance pays off your existing first mortgage. One major difference between the two types of mortgages is the overall cost. However the paid-off loan can stay on your credit report for up to 10 years and continue to impact your scores during that time.

Source: pinterest.com

Source: pinterest.com

Get personalized rates. In todays post we take a quick look at both. If youre having trouble paying a mortgage one option is to refinance. Cash-out refinance pays off your existing first mortgage. Get personalized rates.

Source: fi.pinterest.com

Source: fi.pinterest.com

The purchase mortgage is what allows someone to become a homeowner without having enough cash on hand. However the paid-off loan can stay on your credit report for up to 10 years and continue to impact your scores during that time. A purchase loan is a loan that you obtain when borrowing money from a mortgage lender to purchase a home. As a general rule of thumb the longer the loan the more interest will paid which can make them more expensive. If you refinance your home for its current value you could access the equity accumulated in your property.

Source: mortgagecalculator.org

Source: mortgagecalculator.org

As a general rule of thumb the longer the loan the more interest will paid which can make them more expensive. You cannot refinance without first having a mortgage. To find out lets take a closer look at each. Purchase mortgages may have. Shorter loans may have higher monthly payments associated with them.

Source: pinterest.com

Source: pinterest.com

Both home equity loans and. While there are some similarities there are also some major differences. When you discuss the idea with friends some of them recommend you look into refinancing your current mortgage. A home-loan refinance may lower your equity in the property. One major difference between the two types of mortgages is the overall cost.

Source: pinterest.com

Source: pinterest.com

If you refinance your home for its current value you could access the equity accumulated in your property. Purchase mortgages as the name implies are mortgages used to finance the purchase of a home. However the paid-off loan can stay on your credit report for up to 10 years and continue to impact your scores during that time. Refinances on the other hand are used to refinance an existing mortgage. If you refinance your home for its current value you could access the equity accumulated in your property.

Source: in.pinterest.com

Source: in.pinterest.com

Difference Between Home Equity And Refinance - If you are looking for a way to reduce your expenses then our service can help you find a solution. The argument is that the former concerns moving a loan to a new lender while the latter refers to sticking to the same existing lender for your home loan with a restructured loan. Cash-out refinance pays off your existing first mortgage. If youre having trouble paying a mortgage one option is to refinance. You can also refinance to a lower interest rate if market rates are lower now than when you got your loan.

Source: uk.pinterest.com

Source: uk.pinterest.com

However the paid-off loan can stay on your credit report for up to 10 years and continue to impact your scores during that time. Basically equity is the difference in value between what you owe on an asset and the value of that asset. As a general rule of thumb the longer the loan the more interest will paid which can make them more expensive. Comparing your home equity options infographic The chart below summarises the differences between your three options to accessing your home equity. You can lower your monthly payment by taking a longer term or you can own your home faster and save on interest by shortening it.

Source: pinterest.com

Source: pinterest.com

Comparing your home equity options infographic The chart below summarises the differences between your three options to accessing your home equity. Refinances on the other hand are used to refinance an existing mortgage. Get personalized rates. Quite a few homeowners use the terms interchangeably and often think they are the same. Cash-out refinance pays off your existing first mortgage.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title difference between refinance and home by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.